Minimalism in art favors essentials: pared-down forms, restrained color, and formal clarity. This article outlines its history, core principles and offers practical advice for contemporary artists.

What is minimalist art?

Minimalist art is a mid-20th century movement that seeks to reduce the artwork to fundamental elements — shape, surface, color and material. The aim is to remove anecdote and narrative to create a pure visual and spatial experience.

Core principles

- Reduction: remove excess to keep only what is necessary.

- Geometry & repetition: simple forms and modular repetition.

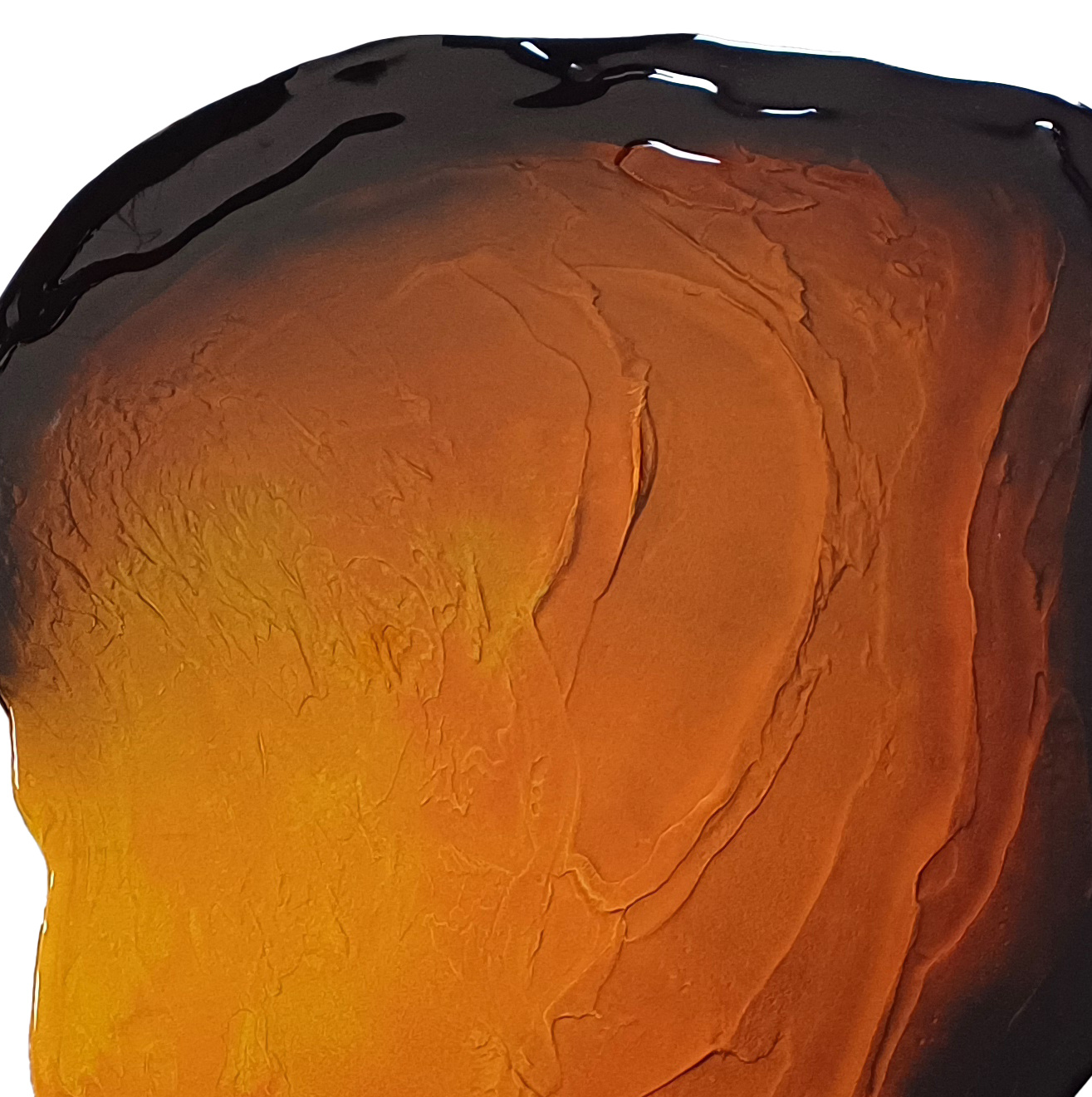

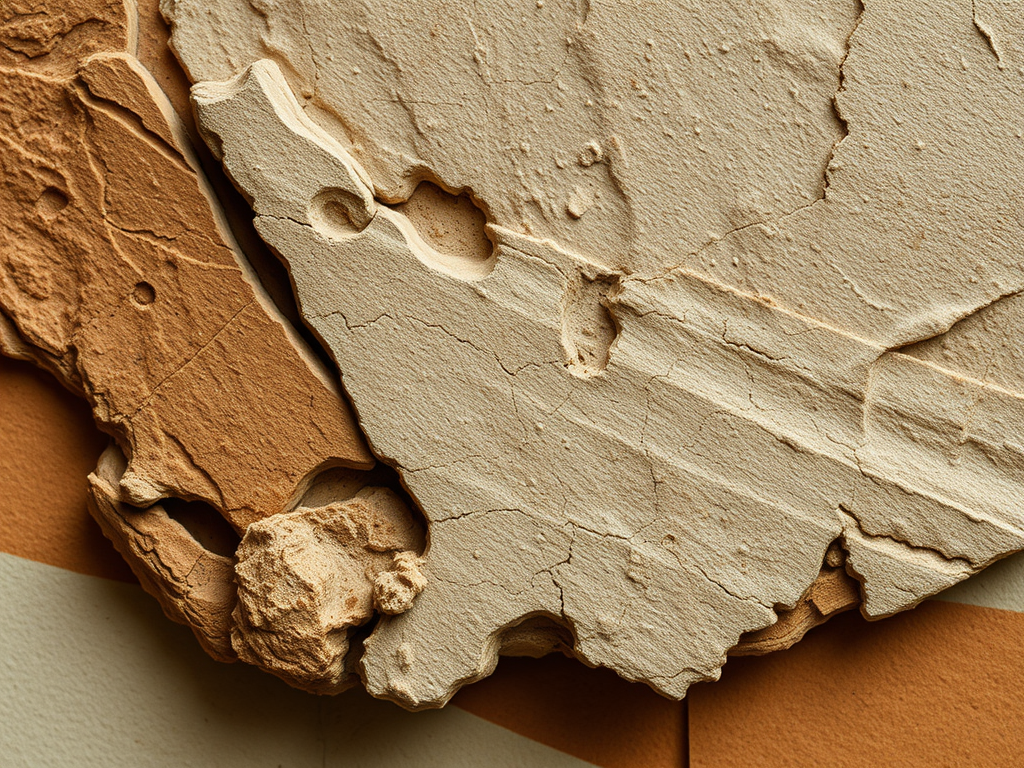

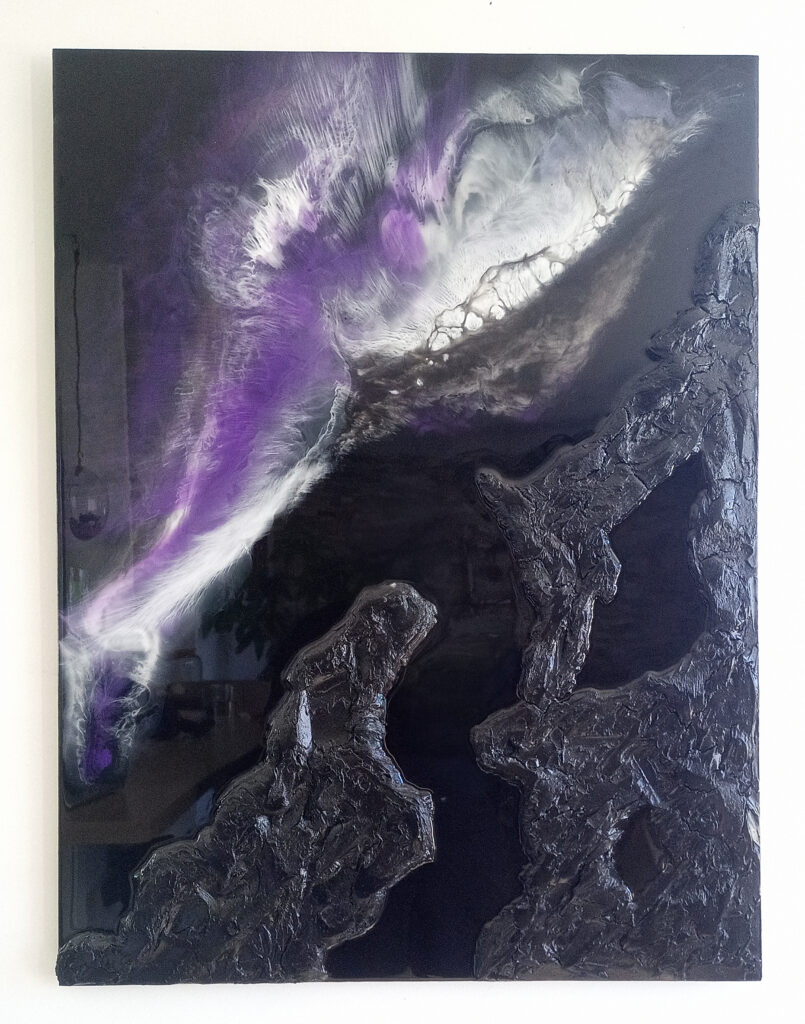

- Materiality: emphasis on texture and raw materials.

- Neutral palettes: subdued tones (black, white, gray, natural hues) or limited pure color use.

- Scale & space: interaction between the object and surrounding space is essential.

Origins and influence

Minimalism emerged in the 1960s in the United States as a reaction to abstract expressionism. Artists such as Donald Judd, Agnes Martin and Carl Andre established its foundations: unemotional objects, industrial fabrication and an absence of pictorial illusion. The movement also drew on Eastern philosophies and conceptual practices emphasizing simplification.

Materials and common techniques

Material choice conveys meaning in minimalist work. Examples:

- Metal, aluminum, steel — industrial surfaces, crisp edges.

- Raw wood — material warmth while retaining simplicity.

- Monochrome canvas — focus on surface and paint density.

- Modular elements — repetitive compositions and series.

How to apply minimalism to your practice

- Set a constraint. Limit your palette to 1–3 colors or work with a single module only.

- Experiment with scale. Try the same composition at different sizes to measure spatial effect.

- Remove narrative. Avoid figurative detail; favor immediate, formal reading.

- Polish finishes. Edges and material joins reinforce the impression of discipline.

- Curate the display. Light, spacing and viewing distance heavily influence reception.

Why minimalism still resonates

Minimalism remains relevant because it answers a contemporary need for visual clarity. In an oversaturated image environment, simplicity creates presence — a quality valued by collectors, designers and brands.

Frequently asked questions

- Is minimalism cold?

- Not necessarily: materiality and scale can convey warmth and emotion without narrative.

- Must I follow strict rules?

- Constraints help, but coherence and intent matter more than formal rules.